Managing your finances effectively is crucial for financial stability and long-term success. One of the simplest and most effective budgeting methods is the 50/30/20 budget rule. This rule, popularized by U.S. Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, provides a straightforward way to allocate your income into three categories: needs, wants, and savings. In this guide, we will explain the 50/30/20 rule in detail, how it works, and how you can implement it in your financial planning.

What Is the 50/30/20 Budget Rule?

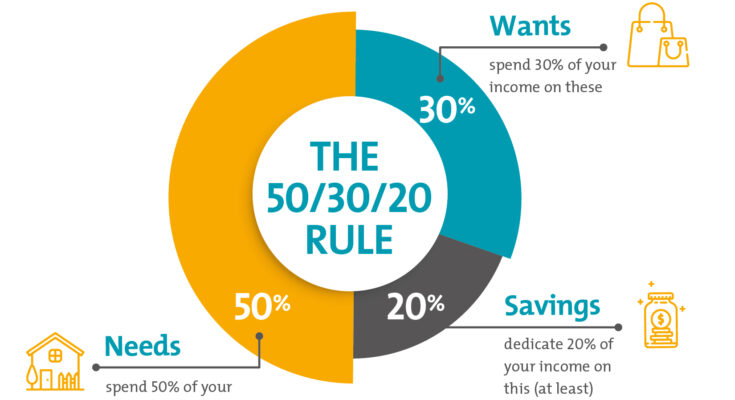

The 50/30/20 rule is a budgeting method that divides your after-tax income into three categories:

- 50% for Needs – Essential expenses required for survival and daily living.

- 30% for Wants – Non-essential spending on things that enhance your lifestyle.

- 20% for Savings & Debt Repayment – Money set aside for financial security and future goals.

This rule is designed to help individuals and families achieve a balanced financial life without overly restricting spending.

Breaking Down the 50/30/20 Rule 50% for Needs

Needs are essential expenses that you must pay to maintain a basic standard of living. These include:

- Rent or mortgage payments

- Utilities (electricity, water, gas, internet)

- Groceries and basic household supplies

- Transportation costs (car payments, gas, public transit)

- Health insurance and medical expenses

- Minimum debt payments (credit cards, loans)

These expenses should not exceed 50% of your after-tax income. If your needs consume more than 50%, you may need to reduce discretionary spending or look for ways to lower essential costs, such as downsizing your home or using public transportation instead of owning a car.

30% for Wants

Wants are non-essential expenses that improve your quality of life but are not necessary for survival. These include:

- Dining out and entertainment

- Streaming subscriptions (Netflix, Spotify, etc.)

- Travel and vacations

- Gym memberships

- Designer clothing and accessories

- Hobbies and recreational activities

This category allows you to enjoy life while keeping your spending in check. If you find yourself overspending in this area, consider cutting back on unnecessary expenses to stay within the 30% limit.

20% for Savings and Debt Repayment

The remaining 20% of your income should be allocated toward building financial security. This includes:

- Emergency fund contributions

- Retirement savings (401(k), IRA, or pension)

- Paying off high-interest debts (credit cards, personal loans)

- Investments (stocks, real estate, mutual funds)

Prioritizing savings and debt repayment ensures financial stability and prepares you for the future. Experts recommend having at least 3-6 months’ worth of expenses in an emergency fund to cover unexpected costs like medical emergencies or job loss.

Example of the 50/30/20 Budget Rule in Action

Let’s say your monthly after-tax income is $4,000. Here’s how you would allocate it using the 50/30/20 rule:

| Category | Percentage | Amount ($) |

|---|---|---|

| Needs | 50% | $2,000 |

| Wants | 30% | $1,200 |

| Savings & Debt Repayment | 20% | $800 |

If your expenses exceed the allocated percentages, you may need to adjust your spending habits or increase your income.

How to Implement the 50/30/20 Rule

Step 1: Calculate Your After-Tax Income

Your after-tax income is the amount you take home after deductions like taxes, Social Security, and health insurance. If you are self-employed, subtract estimated taxes from your gross income.

Step 2: Categorize Your Expenses

List all your expenses and classify them into needs, wants, and savings. Be honest about what is truly essential versus discretionary.

Step 3: Adjust Your Spending

If one category is too high, look for ways to cut costs. For example:

- If needs exceed 50%, consider reducing rent, utility bills, or grocery expenses.

- If wants exceed 30%, limit dining out or cancel unused subscriptions.

- If savings are less than 20%, find ways to save more, like setting up automatic transfers to a savings account.

Step 4: Track Your Budget

Use budgeting apps like Mint, YNAB, or Personal Capital to track your spending and ensure you stick to the 50/30/20 rule.

Pros and Cons of the 50/30/20 Budget Rule

✅ Pros:

✔ Simple and Easy to Follow – No complex calculations, just three categories.

✔ Encourages Financial Balance – Covers essentials, enjoyment, and future security.

✔ Works for Various Income Levels – Adaptable for different financial situations.

✔ Reduces Financial Stress – Ensures savings and debt repayment are prioritized.

❌ Cons:

✖ May Not Work for High-Cost Living Areas – Rent and basic expenses may exceed 50% in expensive cities.

✖ Not Ideal for People with High Debt – Those with significant debt might need to allocate more than 20% to debt repayment.

✖ Requires Discipline – Sticking to the budget requires tracking expenses and adjusting habits.

Alternatives to the 50/30/20 Rule

If the 50/30/20 budget doesn’t fit your financial situation, consider these alternatives:

80/20 Budget Rule – Save 20%, spend 80% on everything else (simplified version). Zero-Based Budget – Assign every dollar of income to a specific purpose. 60/20/20 Budget Rule – 60% for needs, 20% for wants, and 20% for savings (better for high-cost areas).

Choose a method that works best for your financial goals.

Conclusion

The 50/30/20 budget rule is a simple yet powerful way to manage your finances effectively. By dividing your income into needs, wants, and savings, you can maintain financial stability while still enjoying life. Whether you’re looking to get out of debt, build savings, or take control of your spending, this budgeting method can help you achieve your goals.

Start implementing the 50/30/20 rule today, track your expenses, and watch your financial situation improve. Remember, financial success is about consistency and making informed decisions.